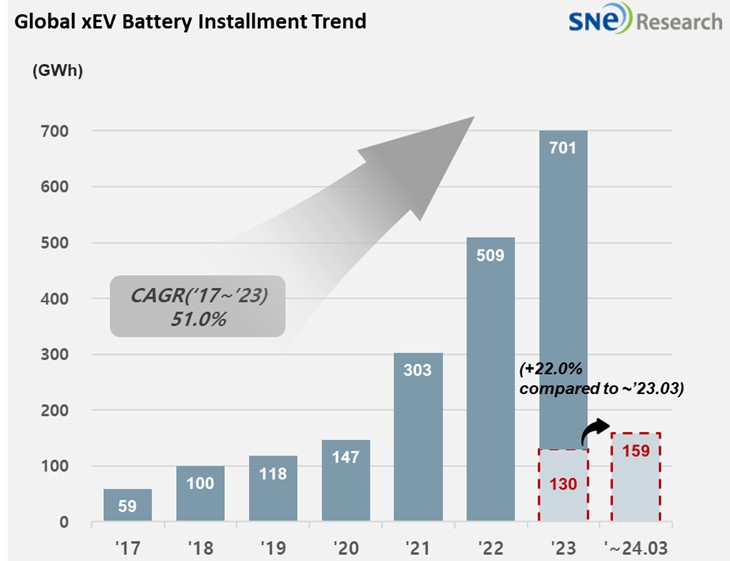

From Jan to Mar 2024, Global EV Battery Usage Posted 158.8GWh, a 22.0% YoY Growth

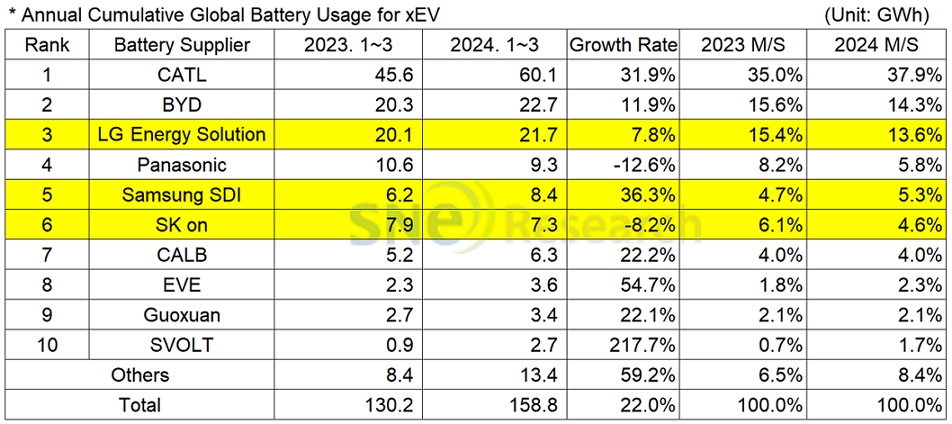

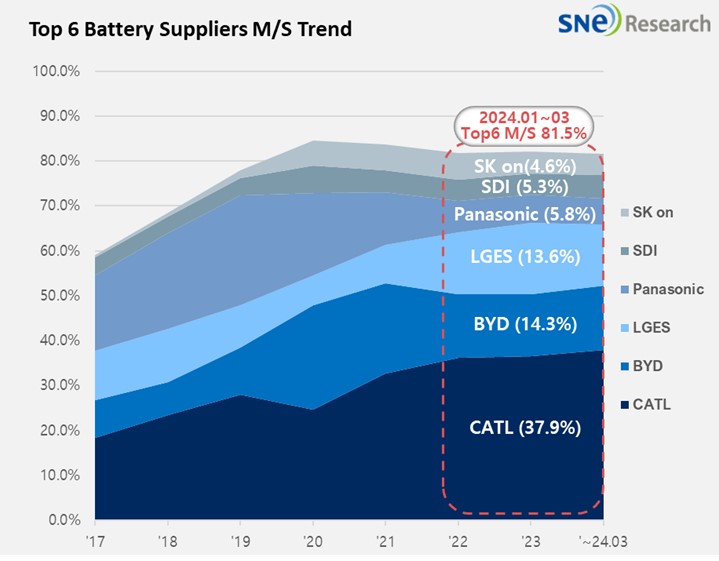

- From Jan to Mar 2024, K-trio’s M/S recorded 23.5%

From

January to March 2024, the amount of energy held by batteries for electric

vehicles (EV, PHEV, HEV) registered worldwide was approximately 158.8GWh, a 22.0%

YoY growth.

(Source: 2024 April Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 23.5%, declined by 2.8%p compared to the same period of last year. LG Energy Solution ranked 3rd with a 7.8% (21.7GWh) YoY growth, while Samsung SDI recorded the highest growth of 36.3% (8.4GWh) among the K-trio battery makers. On the other hand, SK On showed a degrowth of -8.2% (7.3GWh).

(Source: 2024 April Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look the usage of battery made by the K-trio, Samsung SDI continued to be in an upward trend thanks to solid sales of BMW i4/5//X and Audi Q8 e-Tron as well as PHEV in Europe. Strong sales of Rivian R1T/R1S in North America also propped up the growth of Samsung SDI. Targeting the premium EV battery market for BEV and PHEV, Samsung SDI was the only Korean battery maker in black in Q1 2024 based on a rapid growth of high-value-added battery P5.

SK On saw its battery usage 8.2% lower than that of the same period of last year. Although Ford F-150 enjoyed favorable sales in North America, Hyundai IONIQ 5 and KIA EV6 saw a decrease in sales in other regions, leading to a degrowth. With its performance slowed down in Q1, SK On announced that it will slow down the pace of ‘Carbon to Green’ strategy implementation accordingly. The steady sales of Mercedes EQ line-up and the global sales expansion of KIA EV9 have been positive signs for the battery maker.

LG Energy Solution’s growth was led by sales of highly popular vehicle models in Europe and North America such as Tesla Model 3/Y, Ford Mustang Mach-E, and Hyundai IONIQ 6. In Q1 2024, LGES saw its operating profit (excluding Advanced Manufacturing Production Credit) in red, and it announced that it would downscale investments in equipment by carefully prioritizing its investment plans. However, as the production volume from Ultium Cells 2nd factory has increased and a new model from GM with the Ultium Platform applied is scheduled to be released, LG Energy Solution is expected to lead the North American market with its ternary battery meeting the IRA regulations.

Panasonic, the only Japanese company in the top 10 on the list, recorded 9.3GWh from Jan to Mar this year and ranked 4th on the list, but it posted a 12.6% YoY degrowth. Panasonic, one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla Model Y in the North American market. As Panasonic is reported to unveil its advanced 2170 and 4680 cells, it is expected to expand its market share mostly focusing on Tesla.

CATL, firmly stayed on the top position with a 31.9%(60.1GWh) YoY growth. CATL was the only battery maker taking up a market share over 30% by supplying its battery to major brand vehicles such as ZEEKR and Ideal, in the Chinese domestic market, regarded as the world’s biggest EV market, and also to vehicles of global major OEMs such as Tesla Model 3/Y, BMW iX, Mercedes EQ Series, and VW ID Series.

Unlike the last month when it saw a sudden drop in its EV sales due to the influence of Chinese New Year holidays, BYD enjoyed a steep increase in sales in March, posting a 11.9%(22.7GWh) growth and capturing the 2nd place on the list. Recently, it has been working on a full operation of production line in Thailand, helping it rapidly expanding its presence on the global stage other than the Chinese market.

Despite strict regulations from the US, CATL and BYD boasted stable sales and operating profits in Q1 2024. Both of them have benefitted from price competitiveness based on vertical integration which has been working as a huge advantage in the recent market where demand has temporarily slowed down.

(Source: 2024 April Global Monthly EV and Battery Monthly Tracker, SNE Research)

Globally, consumers’ preference for BEV has reduced, while the growth of PHEV and HEV has been higher than expected. Continued high interest rates, expensive electric vehicles, and shortage of charging infrastructure are pointed out as major causes. In addition, a decline in metal price and increase in PHEV and HEV of which capacity is lower than BEV also bring about a negative impact on the battery industry. In particular, as the EV sales in Europe and the US in Q1 2024 are turned out to be lower than expected, the market shares of K-trio battery makers have reduced, accordingly. However, from the latter half of 2024, new electric vehicle models are planned to be released in the US and European markets, where competition with China is relatively less fierce. In addition, the Korean battery makers are planned to establish joint ventures in the US where a high growth in the market is expected. All of these may add up to gradually relieve frustrations in the market.

[2] Based on battery installation for xEV registered during the relevant period.